KHEMARAK WALLET

Empowering Lives, One Transaction at a Time

“Introducing KHEMARAK WALLET, a revolutionary digital payment platform designed to bring the worlds of electronic payments and microfinance together. Our goal is to streamline financial inclusivity and provide robust, secure, and straightforward transaction solutions for microfinance institutions and their clients. Through our platform, we aim to play a pivotal role in the global fight against poverty, fostering economic empowerment and sustainable development in underserved communities.

Key Features:

Accessible Micro-Transactions: Our system is optimized for high-volume, low-value transactions, typical of microfinance operations, without hefty processing fees.

Mobile Money Integration: Facilitate financial access for clients in remote areas with no banking infrastructure by integrating mobile money services.

Flexible Payment Options: From traditional banking to digital wallets, we accommodate a plethora of payment avenues, ensuring no one is left behind.

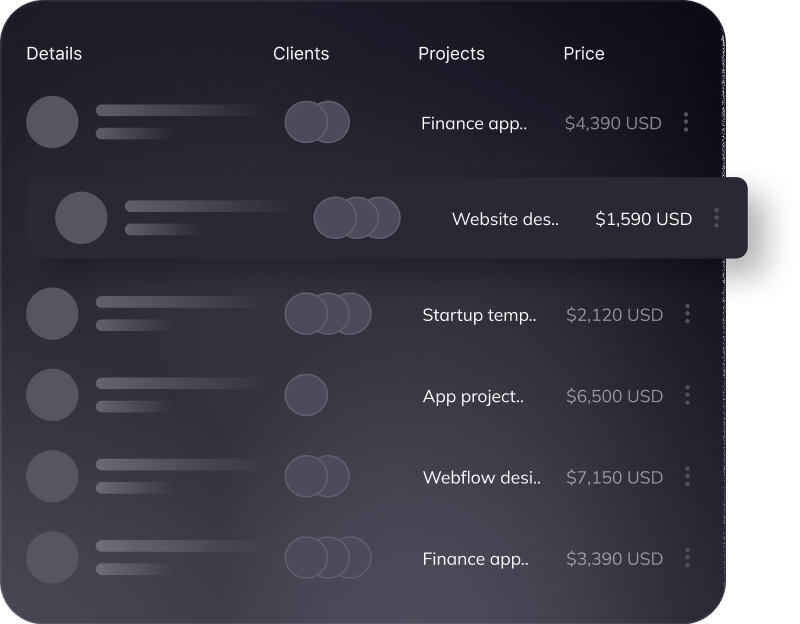

Enhanced Loan Management: Enable MFIs to disburse loans, receive repayments, and manage accounts efficiently through our platform, simplifying access to credit for small entrepreneurs.

Building Cooperation with Microfinance Institutions:

Financial Literacy Modules: We offer educational resources on basic financial literacy, savings, and debt management, directly through our platform, promoting responsible borrowing and economic sustainability.

Data Security and Compliance: Our platform guarantees top-tier data security, respecting user privacy and adhering to international regulatory standards.

Community Impact Tracking: MFIs can monitor and analyze the impact of their loans on individual and community levels, providing valuable data for strategy optimization and reporting to stakeholders.

Manage On The Go

By facilitating efficient and secure transactions, KHEMARAK WALLET aims to boost the operational capacity of microfinance institutions, thereby increasing their outreach and impact. More people can thus gain access to crucial financial services, empowering them to invest, grow their businesses, and ultimately break the cycle of poverty.

Join us on this remarkable journey to make a tangible difference in the world with every transaction and pave the way for a more inclusive global economy.”

Frequently Asked Questions

How does KHEMARAK WALLET ensure the security of microtransactions, especially for users in underserved areas?

KHEMARAK WALLET prioritizes the security of all transactions, big or small. We utilize advanced encryption technologies to protect data during transmission and storage, ensuring sensitive information remains confidential and secure. Furthermore, our system complies with global cybersecurity standards and employs continuous monitoring to safeguard against unauthorized access or fraud. For users in underserved areas, particularly where digital literacy might be lower, we provide straightforward, user-friendly security protocols and education on safe digital financial practices.

Can KHEMARAK WALLET function in areas with limited internet connectivity or technological infrastructure?

Absolutely. KHEMARAK WALLET is designed with inclusivity in mind, meaning it’s built to operate across diverse environments. The platform integrates with mobile money and SMS-based transactions, allowing users to conduct secure transactions without the need for high-speed internet or advanced devices. Our goal is to ensure that the benefits of digital financial services extend to even the most remote or underserved communities, bridging the gap in financial inclusivity.

What measures does KHEMARAK WALLET take to promote responsible borrowing and lending practices?

KHEMARAK WALLET is committed to advancing financial literacy and responsible financial behaviors. Our platform features educational modules that guide users on critical aspects of financial health, including debt management, savings, and the principles of responsible borrowing and lending. Moreover, we work closely with microfinance institutions to implement transparent lending policies and fair interest rates, alongside tools for both lenders and borrowers to track and manage loans effectively, encouraging accountability and sustainable financial growth.

How does KHEMARAK WALLET handle regulatory compliance across different regions and countries?

Regulatory compliance is paramount in the financial sector, and KHEMARAK WALLET is dedicated to upholding the highest standards. We have a team of legal experts who continuously monitor and adapt to regulatory changes in the regions we operate. We work collaboratively with local authorities and financial institutions to ensure our services meet compliance requirements. Additionally, EmpowerPay supports MFIs in navigating these regulations, providing resources and assistance in fulfilling necessary legal and financial reporting obligations.

Company Service

Contact Us

Terms of Service

Support